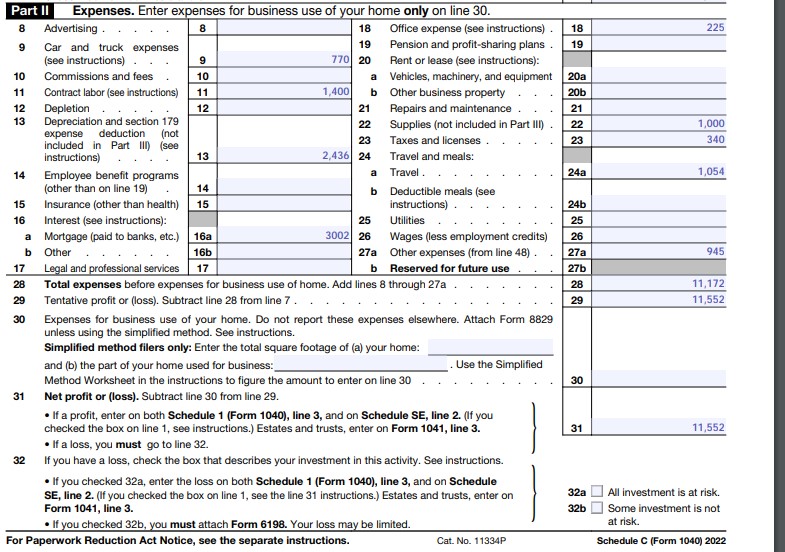

2024 Home Office Deduction Schedule C

2024 Home Office Deduction Schedule C – Additionally, the IRS adjusted its standard deduction for 2024. That allows for households to deduct more of their expenses from qualified deductions (such as mortgage insurance, charitable . The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you .

2024 Home Office Deduction Schedule C

Source : thecollegeinvestor.com

The Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Tax advice for clients who day trade stocks Journal of Accountancy

Source : www.journalofaccountancy.com

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

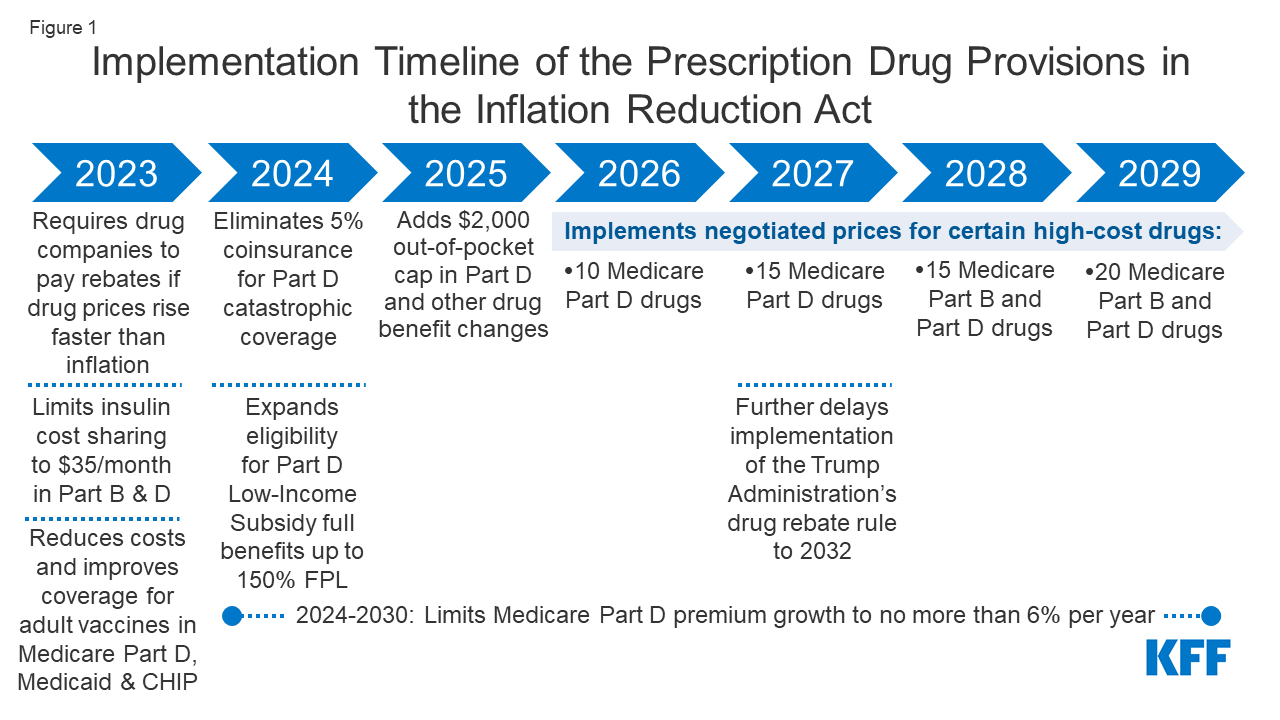

How Will the Prescription Drug Provisions in the Inflation

Source : www.kff.org

Dublin Nissan Bay Area Nissan Dealer Near Hayward, San Leandro

Source : www.dublinnissan.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Recreational Cannabis Businesses

Source : www.nj.gov

2024 Home Office Deduction Schedule C When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: 2024 Standard Deduction Amounts For 2024, the additional standard deduction amount for the aged or the blind is $1,550. The additional standard deduction amount increases to $1,950 for unmarried . The standard deduction, or the specific dollar amount that reduces the amount of income on which you’re taxed, is changing for 2024 as well. For married couples filing jointly, the standard .